by: ProfMKD @ 9:50 pm | 0 comments

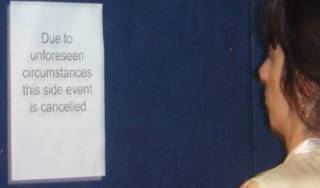

Room 2 of the EU Pavilion at COP 10 remained dark and empty at 1pm, the scheduled time for a presentation by World Bank Carbon Finance Director, Ken Newcombe. When asked why the event was cancelled, an EU official replied "I cannot say".

by: ProfMKD @ 1:09 pm | 0 comments

Ken Newcombe, Director of World Bank Carbon Finance, at a joint meeting with the carbon trading industry on December 10.

by: ProfMKD @ 10:22 am | 0 comments

Special Report from inside a World Bank / carbon finance business meeting

Notes from a presentation by Ken Newcombe, Carbon Finance Director, World Bank, to “Lessons Learned from the CDM Market,” a joint event of the International Emissions Trading Association and the World Bank held at the Four Seasons Hotel in

Article by Jim Vallette, Sustainable Energy and Economy Network

Ken Newcombe, the World Bank’s leading advocate of carbon finance, made a rather pessimistic presentation to the carbon trade business leaders gathered at the posh Four Seasons Hotel, far from the site of COP10. (The World Bank has not been very visible inside the massive exhibition warehouse that is hosting COP10. Climate Convention veterans tell us that the Bank's profile is much lower than previous meetings.)

Newcombe emphasized that “low hanging fruit” – particularly HFC and N2O projects – provided the most realistic CDM schemes before the mechanism expires in 2012. He predicted that N2O and HFC23 projects would result in 1 billion tons of emissions trade by 2012. For other projects, he said, it is “not realistic to expect more than 200 to 300 million tons to be entered into CDM registries by 2012.”

Further, “N2O and HFC23 don’t need a lot of carbon finance, don’t present a financing challenge to the enterprise, and don’t present a financing challenge to the enterprise.” Newcombe said these projects represent a minimal delivery risk and are “perfectly legitimate” under the Kyoto Protocol. N2O and HFC23 projects “must be available in significant volumes” for “ratifying OECD countries to meet their objectives” under

[Back in the late 1990s, when the World Bank began implementing its own version of a Clean Development Mechanism, the Prototype Carbon Fund, Newcombe assured NGOs that the PCF would be “entirely renewable.” Its subsequent emphasis on N2O and HFC conversion projects have been controversial among carbon trading proponents in the NGO community.]

Newcombe reflected that one “can see how different the (carbon trading) market is from when the Kyoto Protocol was envisioned. Most people would see this as a great boost for renewable energy.” While recognizing that the carbon market has hardly touched renewable energy, he described the existing portfolio as “an unfolding agenda, a very pleasant surprise. Even at the prices we see today, (these projects represent) upgrades of infrastructure for growth.”

He said renewable energy was burdened by unlevel playing fields, particularly CDM methodologies that pose a “serious paradox. One would expect that CDM would support wind, solar, small hydro. But CDM methodologies make it very difficult.”

Newcombe continued that he sees “in (carbon) sequestration another much maligned project class. Lots of people don’t want sinks in the CDM… (and envisioned) wall-to-wall eucalyptus plantations. That spectre has meant that sub-regional regulators have managed to restrict assets.” He lamented that these sinks projects, “more than any other, support poverty alleviation and carbon reduction, (and) support poor countries in mitigating climate change. Inclusion is very important.”

Newcombe closed with a pessimistic view of future emissions reductions through the CDM. “There is a closing window – by 2006 or 2007. There might be unpopular assets in some parts of the market,” he said. The CDM might not “be seen to be a viable contributor to their needs. We’re rapidly losing opportunities – even for renewables by two years out.”

In a reprise of a 1997 World Bank document published in SEEN’s new report, A Wrong Turn from

When the

The chair of the IETA-World Bank meeting then invoked “Chatham House Rules,” meaning that notes could not be taken from the meeting. The above notes were taken prior to these rules being invoked. Nadia Martinez of the Institute for Policy subsequently asked Mr. Newcombe whether the Bank received any commissions from carbon trading, and whether the carbon finance program is a conflict of interest with the Bank’s massive fossil fuel portfolio. Due to the invocation of the Chatham House Rules, we can not repeat his answers. We were surprised by this invocation of secrecy; this meeting was adverstised as an "open discussion" in leaflets distributed at COP10.

Martinez

Further information about the evolution of the World Bank’s carbon finance, renewable energy, and fossil fuel programs is available in SEEN’s new report, A Wrong Turn from Rio: The World Bank’s Road to Climate Catastrophe, available in Spanish and English at: http://www.seen.org .

by: ProfMKD @ 6:40 am | 3 comments